Generally, a Syndicated conservation easements’ charitable contribution deduction is not allowed for a charitable gift of property consisting of less than the donor’s entire interest in that property.

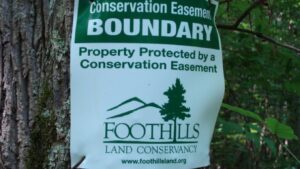

However, the law provides an exception for a “qualified conservation contribution” that meets certain criteria, including exclusive use for conservation purposes.

If taxpayers meet the criteria in the tax code and regulations, they may claim charitable contribution deductions for the fair market value of conservation easements they donate to certain organizations.

If taxpayers meet the criteria in the tax code and regulations, they may claim charitable contribution deductions for the fair market value of conservation easements they donate to certain organizations.

Some promoters are syndicating conservation easement transactions that purport to give investors the opportunity to obtain charitable contribution deductions and corresponding tax savings that significantly exceed the amount an investor invested.

Typically, promoters of these schemes identify a pass-through entity that owns real property or form a pass-through entity to acquire real property.

The promoters syndicate ownership interests in the pass-through entity or tiered entities that own the real property, suggesting to prospective investors that they may be entitled to a share of a charitable contribution deduction that greatly exceeds the amount of an investor’s investment.

The promoters obtain an inflated appraisal of the conservation easement based on unreasonable factual assumptions and conclusions about the development potential of the real property.

The promoters obtain an inflated appraisal of the conservation easement based on unreasonable factual assumptions and conclusions about the development potential of the real property.

In Conservation Easements the IRS advises that certain of these transactions are tax avoidance transactions and identifies them and similar transactions as Listed Transactions.

The notice applies to transactions in which the promotional materials suggest to prospective investors that they may be entitled to a share of a charitable contribution deduction that equals or exceeds two and a half times the amount invested.

Individuals entering into these and substantially similar transactions must disclose them to the IRS. In addition, material advisors in those transactions may have disclosure and list maintenance obligations.

In December 2018, the Department of Justice sued to shut down promoters of a conservation easement syndicate scheme. For more see DOJ Press Release 18-1672.